Deciphering Chipsets: A Broadcom Focus

When network equipment vendors offer similar hardware at competing price points, and position these products to achieve specific technical goals, the best way to decipher a product’s potential is by learning about the underlying silicon, or thoroughly investigating the chipset itself.

Vendor Silicon vs Merchant Silicon

Network equipment vendors tend to have multiple hardware offerings (e.g., Juniper creates separate product families across their lines of MX, EX, QFX, PTX, etc…). Although similar in appearance at a glance, when actually comparing these product lines which are developed for specific-use applications, there are often major differences between feature sets, performance, and price-points.

The main reason for these major differences tends to lie in the silicon used in each box. In this context, silicon refers to the designer of the chipset which acts as the “brain” of the device. There are two main classes of network equipment silicon. Vendor silicon: chipsets that are designed in-house by the vendor themselves (e.g., Juniper’s Trio or Express). Merchant silicon: chipsets bought in from an external designer/vendor (e.g., Broadcom’s Trident or Jericho).

The bottom line is chipsets are an expensive item to design in-house. While a vendor gains much from developing their own silicon, using an externally designed chipset makes sense for less feature rich (i.e., general purpose) products. Using externally designed merchant silicon allows a vendor to massively reduce the cost and time to bring a new product to market.

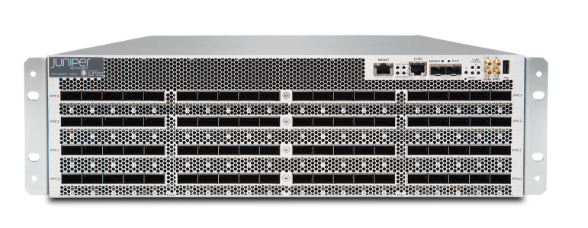

Typically, a chipset is developed for a specific market or product use-case in mind, and then further tuned into a granular focused and demanding feature set. Juniper designs their in-house silicon for their flagship MX and PTX lines (Trio and Express, respectively); these chipsets offer enormous scale for routing (Trio in MX) and switching (Express in PTX). However, Juniper also provides lesser feature-rich switching and routing options at lower price points by employing merchant silicon for product lines like the EX and QFX.

Enter Broadcom

Broadcom, started in 1961 as a subsidiary of HP, remains the main market leader in merchant silicon thanks to their introduction of the Trident chipset in 2010. The Trident offered up to 640Gbps in a single ASIC, creating a wave of 1U “pizza box” switches configured mainly with 48x10G front panel density and 4x40G for stacking. Unsurprisingly, these low cost, performance oriented 1U boxes for top of rack and DCI type applications replaced the then larger, high-priced chassis-based boxes. This brought a wave of changes to network topologies thanks to the introduction of features like VXLAN and SPB.

There are a host of merchant silicon providers like Cavium, HiSilicon or Intel, who also offer chipsets that fit well in certain roles. However, let’s explore three popular offerings from Broadcom’s merchant silicon for general purpose routing and switching:

Trident (Trident+, Trident 2, Trident 3, Trident 4C)

The main focus for the Trident chipset is layer 2 switching typically seen in enterprise/campus applications, and some datacenter fabric environments. Trident is strong in port density of lower speed ports (10G, 40G etc), and is also capable of some basic routing and packet manipulation/QoS with mid-level performance. Trident-based boxes are perfect for top of rack environments (i.e., acting as a leaf node). Trident 2 and 2+ were the first chipsets to feature VXLAN support, in the Arista 7050X and X2, respectively, after Arista worked to help standardize the VXLAN protocol in RFC7348.

In the 400G universe, Trident 4 is currently available in the Juniper QFX5130 and Arista 7050X4 family.

Tomahawk (Tomahawk, Tomahawk 2, Tomahawk 3, Tomahawk 4)

Tomahawk spawned from the development of Trident shortly after the release of Trident 2. Tomahawk’s initial focus was to bring affordable high density 100G to the same market as Trident. With a focus towards the hyperscale environment and extremely high throughput, the latest generation Tomahawk ASIC can handle up to 25.6Tbps of traffic. Tomahawk-based boxes are ideal for high-capacity DCI environments (i.e., acting as a spine node).

Current models featuring the latest generation Tomahawk 3 and 4 chipsets are the Arista 7060X5 (plus the chassis variant Arista 7388X5) and the Juniper QFX5220.

Jericho (Jericho+, Jericho 2, Jericho 2c/2c+)

Jericho brings Broadcom’s product lineup to the routing world, offering deep packet buffers and routing scale that (when paired with the correct vendor network operating system, such as Arista’s EOS) allows it to handle full routing tables and line-rate routing performance along with rich fabric capabilities. Jericho-based boxes are perfect for BGP-speaking roles such as peering or provider edge, and when used in this role can handle up to 14.4Tbps of throughput, depending on traffic mix.

The latest devices featuring the Jericho 2C/2C+ chipset are the Arista 7280R3 family and some recently released Cisco line cards for the NCS5500 platform.

Network Operating Systems

Why might competing vendor product families have certain feature sets that others don’t? This is a result of the differences between vendor software stacks (think Arista EOS vs Juniper Junos). Vendor software stacks can be developed to selectively ignore certain (merchant) chipset capabilities that would otherwise cannibalize sales of their own vendor-silicon based boxes. It is absolutely essential to research the exact features you intend to use when exploring different vendor offerings instead of assuming that features supported on Vendor A will be supported by Vendor B on the same chipset. Furthermore, use caution when assuming a feature-set that works on vendor chipsets would translate to the merchant silicon models when using the same NOS configuration.

Find Your Mix of Merchant and Vendor Silicon

You might opt to select a more costly box with vendor silicon where you require full performance core routing (Juniper MX with Trio) or a powerful packet transport solution (Juniper PTX with Express). And in the case where your enterprise, campus or datacenter interconnect switching requirements can be met with more limited feature-sets, you can clearly reduce your CAPEX without compromising on network architecture by understanding which merchant silicon solutions work best for you.

We Can Help You

For any questions or guidance in navigating chipsets across Arista, Juniper, and Nokia current generation switching and routing, please reach out to connect with your team at nesevo.

US & Canada: sales-us@nesevo.com

EMEA & APAC: sales@nesevo.com

You want to talk to us? Click here for more contact details.

“Deciphering Chipsets: A Broadcom Focus”: Further recommended resources: Broadcom Buyer’s Guide